Right to work checks

Right to work checks: what are they and how do you do them?

What is a right to work check?

A right to work check is a Home Office process to establish that each employee or casual worker has the right to work in the UK before they start employment.

What amounts to work?

The definition of employment is broad. It covers any work being undertaken on the premises whether paid or unpaid and whether subject to an employment contract or not.

Who carries out the check?

The employer.

Which employees require a right to work check?

The right to work checks need to be conducted for all employees including British and Irish nationals and people with Indefinite Leave to Remain and Settled Status.

Employers must avoid unlawful discrimination by treating someone unfairly because of the type of right to work checks required.

The Home Office recommend that right to work checks are undertaken on self-employed contractors as well as employed staff.

When do you need to do a right to work check?

The check needs to be done before the employees can start their work. If they have ongoing right to work e.g. a British Citizen then no further follow up right to work check is required. If their right to work is for a limited period of time, their documents need to be checked again when it’s due to expire.

What is the consequence of not doing a right to work check?

The Civil Penalty scheme imposes strict liability upon the employer for any failure to carry out the necessary check. The maximum Civil Penalty payable is £20,000 per worker. This can be reduced where mitigating factors are found.

What happens if the employer does the check but it later turns out that the employee does not have the right to work?

An employer who conducts the appropriate right to work checks will have a statutory excuse against liability for a civil penalty in the event they are found to have employed someone who does not have the right to do the work in question. The appropriate checks will depend on the date when the employee commenced their employment.

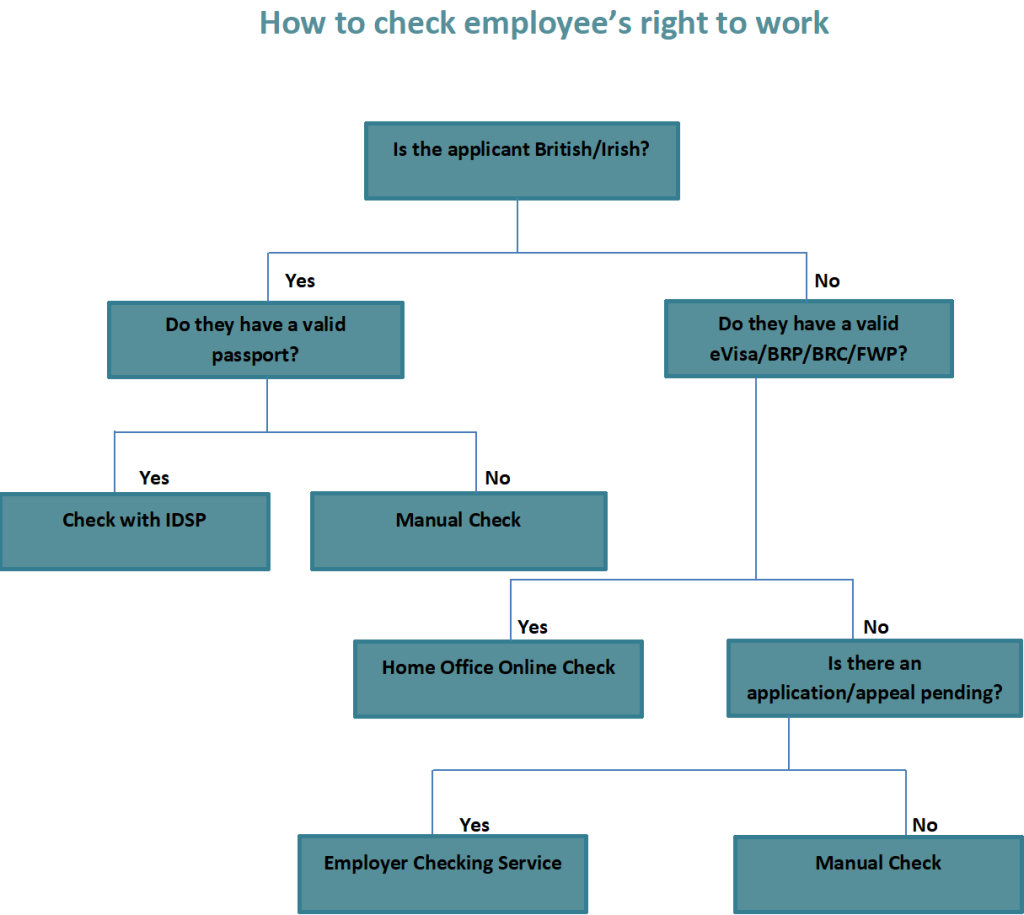

How do you check a prospective employee’s right to work?

This can be done in the following three ways:

- Manual right to work check

The employer must obtain original documents from the employee. These must be from either List A or B of acceptable documents in the Employers’ right to work checklist.

List A documents show that the holder is not subject to immigration control, or has no restrictions on their stay, so they have an ongoing right to work in the UK. These documents could be a person’s passport, residence permit or birth certificate.

List B documents are for employees who are from outside the UK and EEA countries. These documents show that the holder has been granted leave to enter or remain in the UK for a limited period of time or, has restrictions on their right to work.

The employer must check that the documents are genuine and the prospective employee is the rightful owner which allows them to carry out the type of work in question. A clear copy of the document needs to be retained either electronically or in hardcopy in a format which cannot be manually altered.

Changes from 1 October 2022

The Home Office allowed employers to conduct right to work checks remotely as part of the response to coronavirus (COVID-19). This came to an end on 30 September 2022. From 1 October 2022, employers will need to conduct an in-person manual check, check using IDVT or Home Office online right to work check. Employers are not expected to carry out retrospective checks on employees who had the COVID-19 adjusted check between 30 March 2020 and 30 September 2022.

2. Identity Service Provider (IDSP) right to work check

The employer can use Identity Document Validation Technology (IDVT) via the services of an Identity Service Provider (IDSP) to complete the digital identity verification element of right to work checks for British and Irish citizens who hold a valid passport (including Irish passport cards). This is to provide reassurance that the document that the employee is providing is genuine and can be relied upon.

The employer must sill verify themselves that the photograph and document details, are consistent with the details of the employee that they are checking. They can do this in person or via a videocall.

The employer should only accept checks via an IDSP that satisfy a minimum of a Medium Level of Confidence. A list of certified providers is available for employer to choose from on the GOV.UK website: Digital identity certification for right to work, right to rent and criminal record checks. It is not mandatory to use a certified provider. Employers may use a provider not featured within this list if they are satisfied that the particular IDSP are able to provide the required checks.

A clear copy of the IDVT identity check output must be retained by the employer for the duration of employment and for two years after the employment has come to an end.

- Online GOV.UK right to work check

Since 6 April 2022 it has been mandatory to undertake an online right to work check for people who have an eVisa, Biometric Residence Card (BRC), Biometric Residence Permit (BRP) or Frontier Worker Permit (FWP). An employer cannot now just check a physical BRC, BRP or FWP alone as proof of right to work but must do an online check.

The employee first needs to use Prove your right to work to an employer to generate a share code. They then give this share code to the employer who uses View a job applicant’s right to work details to confirm their right to work.

Alternatively, the employer can check the applicant’s original documents if the employee does not provide them a share code but must then use View a job applicant’s right to work details to confirm their right to work.

The employer needs to be satisfied that the online check confirms the individual is entitled to do the work in question and that they are the same person as the photograph on the check. They should retain a clear copy of the check either electronically or in hardcopy for the duration of employment and for two years after the employment has come to an end.

How can you check the right to work of an employee whose application is still with the Home Office or has a pending appeal?

Employees are unable to provide a share code for the employers or use any other type of checks if their application has been submitted and is currently awaiting a decision or if they have a pending appeal.

In this situation the employer must use the Employer Checking Service using the link https://www.gov.uk/employee-immigration-employment-status.

The Employer Checking Service to request the Home Office to confirm the immigration status of employees who are unable to show documents or use the online check to demonstrate their right to work.

This service only needs to be used if the employer cannot check the applicant’s right to work online using their share code or check the applicant’s original documents.

Contact Us

If you need further assistance, please call our friendly, experienced personal immigration solicitors on 0191 232 9547, contact us using this form or email the team Immigration.Enquiries@davidgray.co.uk so we can guide you and advise you through this complex and ever changing process.